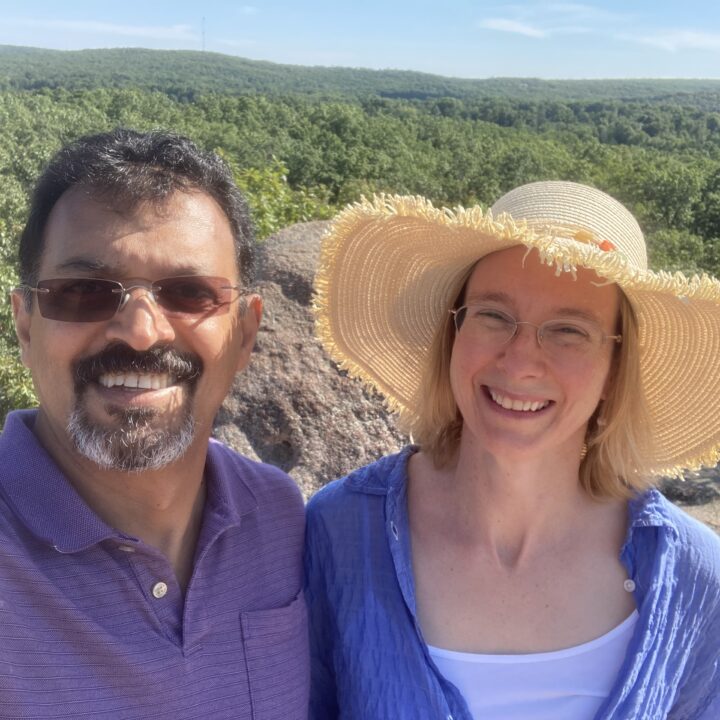

Alumni Spotlight: Lisa John and Rajeev John

As Brown School students, Lisa and Rajeev John studied social work because they wanted to solve problems and make a difference in the world. As Brown School alumni, their goals remain the same. The couple continues to give back to the school where it all began so that their support might write a new beginning for someone else.